step 3. Implement otherwise Score Pre-Accepted for your FHA Mortgage

- How many FHA funds maybe you have finalized?

- The length of time could you be control FHA financing?

- Exactly how many years of sense are you experiencing while the financing officer?

- Just what portion of brand new fund you topic try FHA finance?

- What is the greatest issue to possess obtaining acceptance getting an enthusiastic FHA loan?

- Precisely what do you suggest I actually do to keep the new recognition process swinging along?

- Just how long do you believe my FHA application for the loan usually takes getting canned?

- What is actually your prosperity rates getting getting final recognition for the FHA loan candidates?

After you inquire the mortgage manager these issues, request a good faith Imagine. This can tend to be an estimate of one’s loan will cost you, including the rate of interest, settlement costs, term insurance and costs. You may also have to measure the ideas of every mortgage manager your consult with too.

You are entitled to a loan provider giving your with lower will cost you and an excellent customer service through the channel essential to you, such on line or in-person, and you can a loan officer we would like to run regarding the FHA home loan process. Within CIS Lenders, our attributes might help build your imagine homeownership come true.

Getting Pre-Approved to possess a keen FHA Mortgage

Whilst getting pre-recognized for an enthusiastic FHA loan are an optional step, its highly recommended. Pre-approval refers to the techniques when a loan provider ratings debt disease to decide whether you are entitled to an enthusiastic FHA mortgage as well as how much they’re able to lend your. This process is known as pre-approval since it takes place ahead of domestic bing search in fact it is not certified recognition to your last mortgage.

Should you get pre-acknowledged for an FHA financing, you can confirm a mortgage lender enjoys screened loans Bristol you, and you can display which pre-approval page with sellers when you create a deal into the an effective household. A vendor will be more probably accept their offer when you have got a pre-acceptance letter. Once you try pre-approved, you can begin in search of a home on the spending budget.

Ideas on how to Apply for an FHA Mortgage

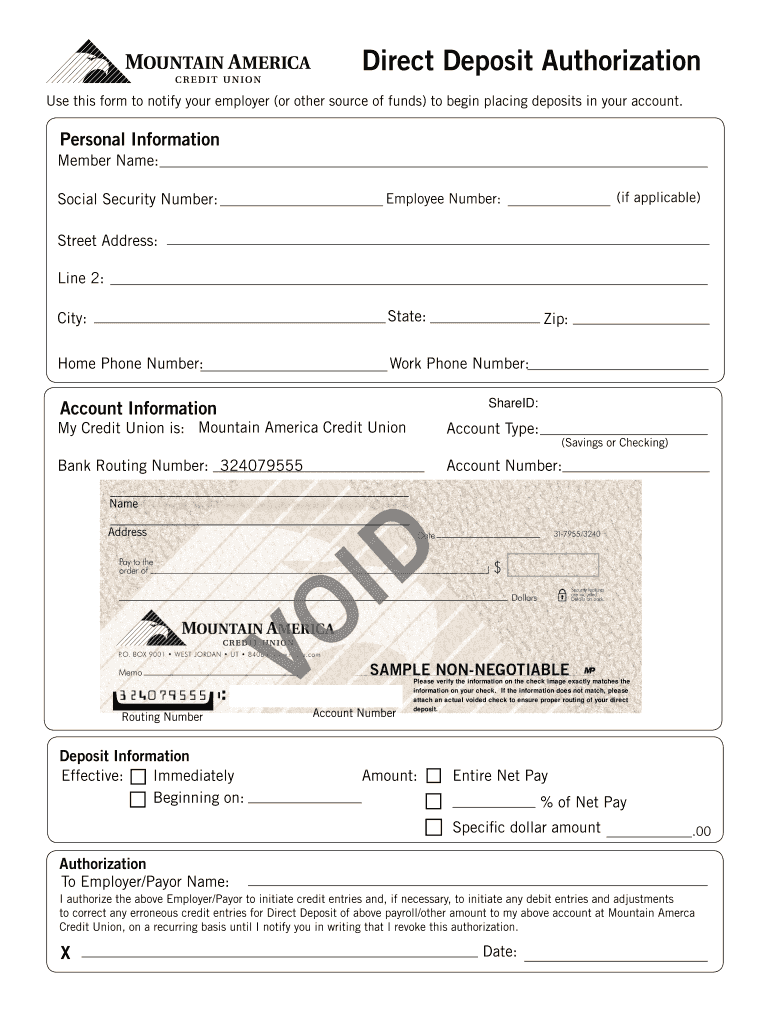

After you come across a house and make an offer, might over a Uniform Residential Loan application, also known as Fannie mae setting 1003, if you get fill out this type in the a different sort of stage of the techniques. About this app, you’ll supply the assets address plus the variety of loan you need. In the event your financial asks one done it software earlier in the process, such as inside pre-approval phase, might log off brand new range into possessions address empty.

Finishing the loan software can take a while, and should have a good amount of information regarding hands, including:

- Recurring costs

Be truthful on the loan application and you can over it to your good your understanding. At this time, you’ll be able to need to pay a fee for the loan app. Or even, your lender may include that it commission on your closing costs, you shell out at the end of the process.

4. FHA Property Review and you will Assessment

After you have been approved to have an enthusiastic FHA financing, now what? Among the 2nd actions to purchasing a home that have a keen FHA mortgage was agreeing so you’re able to an enthusiastic FHA examination because of the an approved appraiser who can determine the worth of your house.

FHA Evaluation Procedure

When you have taken out an enthusiastic FHA mortgage, your property appraiser will do property assessment to determine whether the property meets HUD’s minimum health and safety standards. The latest appraiser can get flag certain issues that have to be remedied through to the FHA loan is funded, such as:

Commenti recenti